Discover Dynamo Daily Insight into Fintech Trends

Introduction

In today's digital age, fintech is evolving rapidly, reshaping how individuals and businesses interact with financial services. Dynamo Daily Fintech Trends offers readers a snapshot of the latest innovations and transformations within this exhilarating sector. As digital technologies continue to pave the way for new financial solutions, staying informed is crucial for anyone partaking in the financial landscape. This article will delve into emerging trends, cutting-edge technologies, and key players driving change. Topics discussed range from AI innovations to blockchain breakthroughs. Our exploration today aims to shed light on evolving practices that are not just reshaping finance but are also influencing industries globally.

Advertisement

Artificial Intelligence in Fintech

Artificial intelligence (AI) is revolutionizing fintech by automating processes, increasing efficiency, and enhancing customer experiences. AI-driven chatbots can provide instant customer service, solving queries and offering financial advice around the clock. Predictive analytics, powered by AI, helps financial institutions anticipate customer needs and tailor services accordingly. Moreover, AI algorithms enable better fraud detection, analyzing transaction patterns to flag suspicious activities proactively. As AI continues to advance, its applications in fintech are expected to diversify, potentially automating everything from underwriting loans to managing investment portfolios. The potential of AI in fintech is vast and only beginning to be harnessed.

Advertisement

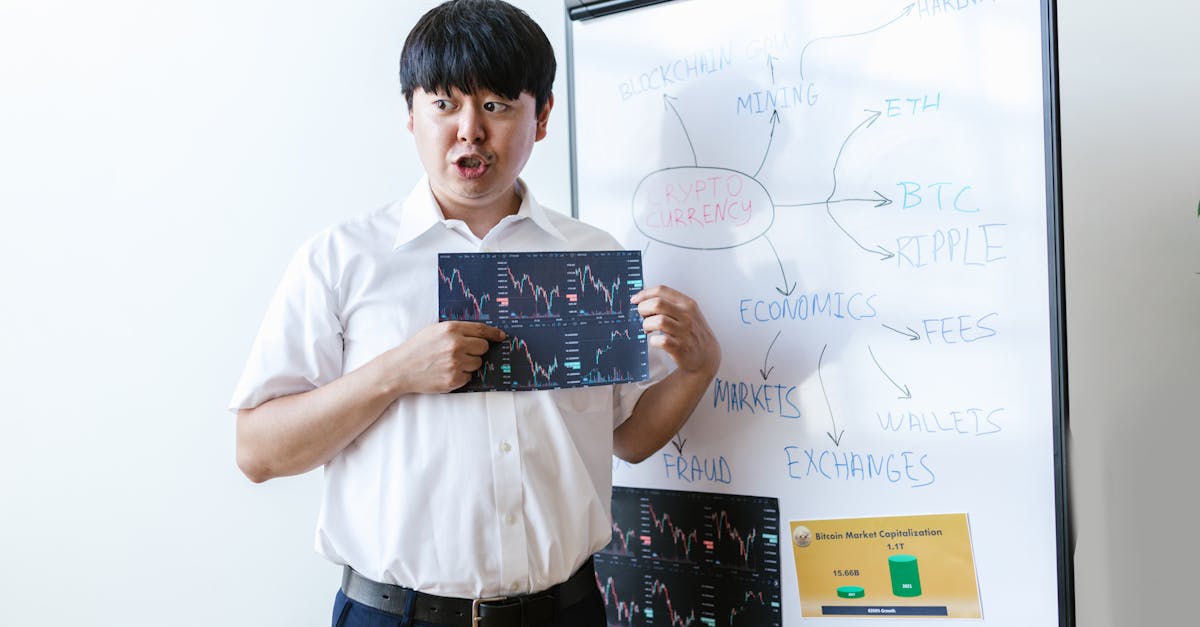

Blockchain and Decentralized Finance

Blockchain technology stands at the heart of decentralized finance (DeFi), ushering in a new era of financial systems. By leveraging distributed ledgers, blockchain ensures transparency, security, and speed. DeFi allows individuals to engage in peer-to-peer lending, trading, and borrowing without traditional banks. Smart contracts used in blockchain facilitate reliable transactions, operating when pre-set conditions are met. With increasing awareness and adoption, DeFi is redefining trust in financial transactions, making them more inclusive and accessible. However, challenges remain, notably regulatory concerns and scalability, which must be addressed before DeFi realizes its full potential.

Advertisement

Digital Wallets and Cashless Payments

As consumers become more tech-savvy, digital wallets and cashless payment options are gaining traction. These tools offer convenience, enabling users to manage their finances anytime and anywhere. Digital wallets, like PayPal and Apple Pay, simplify transactions, amalgamating several payment methods into a single application. This technological shift towards cashless payments is supported by the proliferation of merchant acceptance, from local cafes to large retailers. While critics cite cybersecurity as a potential hindrance, continuous innovations in encryption and digital security strive to mitigate such risks. As this trend burgeons, the global economy is steadily moving towards a cashless future.

Advertisement

Robo-Advisors and Investment

Robo-advisors are transforming investment strategies by making investing more accessible and cost-effective. These platforms utilize algorithms to create and manage investment portfolios tailored to the investor's risk profile and goals. By minimizing human intervention, they lower costs, making financial advisory services attractive to a broader audience. As data analytics improve, robo-advisors are expected to offer even more personalized advice, optimizing investment returns. Their rise signifies a democratization of wealth management, allowing individuals with limited expertise or resources to partake in the stock market confidently. The growth in robo-advisors points to an evolving investment paradigm where technology takes the helm.

Advertisement

Cybersecurity Concerns and Solutions

In tandem with fintech innovations, cybersecurity threats present significant challenges. As digital transactions rise, so do instances of data breaches and cyberattacks, posing risks to both financial institutions and customers. However, fintech companies are equally committed to developing robust cybersecurity solutions. Advanced encryption techniques, biometric verifications, and multi-factor authentications are fortified defenses against threats. Furthermore, cybersecurity education and awareness among users are crucial to safeguarding sensitive financial information. As fintech continues to innovate, prioritizing security will undoubtedly remain a focal point to ensure user trust and a safe financial ecosystem.

Advertisement

Open Banking and API Integrations

Open banking is revolutionizing how banks and financial service providers operate by allowing third-party developers to access shared data through APIs (Application Programming Interfaces). This trend fosters collaboration, spark innovation, and benefits consumers by providing more personalized and comprehensive financial services. With increased access to consumer data, fintech companies can tailor products that better meet customer needs. Nevertheless, it also raises concerns over privacy and data protection, demanding robust frameworks to protect consumer interests. As open banking gains acceptance, it holds the promise of transforming traditional banking models, driving greater inclusion and competition.

Advertisement

Regulatory Landscape and Fintech

While fintech continues to flourish, it's evolving amid a complex regulatory environment. Regulators worldwide are grappling with maintaining consumer protection while fostering innovation. This dynamic landscape calls for a balanced approach—one that encourages growth while minimizing risk. Regulations surrounding data privacy, licensing, and systemic risk management are of utmost importance. Some jurisdictions have adopted sandbox approaches, allowing fintech startups to test innovative solutions under regulatory supervision. This adaptability is crucial for ensuring that regulatory frameworks complement rather than hinder fintech advancement, paving the way for sustainable industry growth.

Advertisement

Global Reach and Impact

The globalization of fintech has unlocked unprecedented opportunities, enabling financial inclusion and access to previously underserved markets. Cross-border payments and remittances have become more seamless, offering speed and reduced costs. Emerging markets are particularly benefiting, where mobile banking solutions provide financial services to remote populations. Global standards and collaborations continue to emerge, ensuring that fintech innovations translate into universal benefits. This ripple effect extends far beyond the financial sector, impacting various industries, from healthcare to transportation, highlighting fintech's potential as a catalyst for cross-industry innovation.

Advertisement

Conclusion

Dynamo Daily Fintech Trends provides a foresight into the ever-evolving terrain of fintech, highlighting its promise and challenges. With groundbreaking advancements like AI, blockchain, and digital payments, fintech is reshaping the financial sector at an unprecedented pace. While new trends offer immense potential, they also bring forth risks and regulatory complexities that need careful navigation. As fintech continues to expand globally, the focus on innovation, security, and regulation remains paramount. This balance will ensure the creation of a resilient fintech ecosystem capable of transforming how the world engages with finance.

Advertisement