Exploring Dynamo Daily 2024 Digital Finance Innovations

Introduction

In a rapidly evolving financial landscape, Dynamo Daily 2024 Digital Finance Innovations stands as a beacon of transformation. As digitization seeps into every aspect of our lives, the financial sector is no exception, experiencing significant shifts that redefine how we view money and transactions. The 2024 edition of Dynamo Daily explores these groundbreaking innovations that promise to transform economic landscapes across the globe. From advanced blockchain technologies to innovative payment methods, these groundbreaking developments are setting the pace for the industry's future. Technology enthusiasts, business leaders, and everyday consumers are tuning in to understand these revolutionary changes. Discover how digital finance innovations are reshaping the way we perceive economics and finance in 2024.

Advertisement

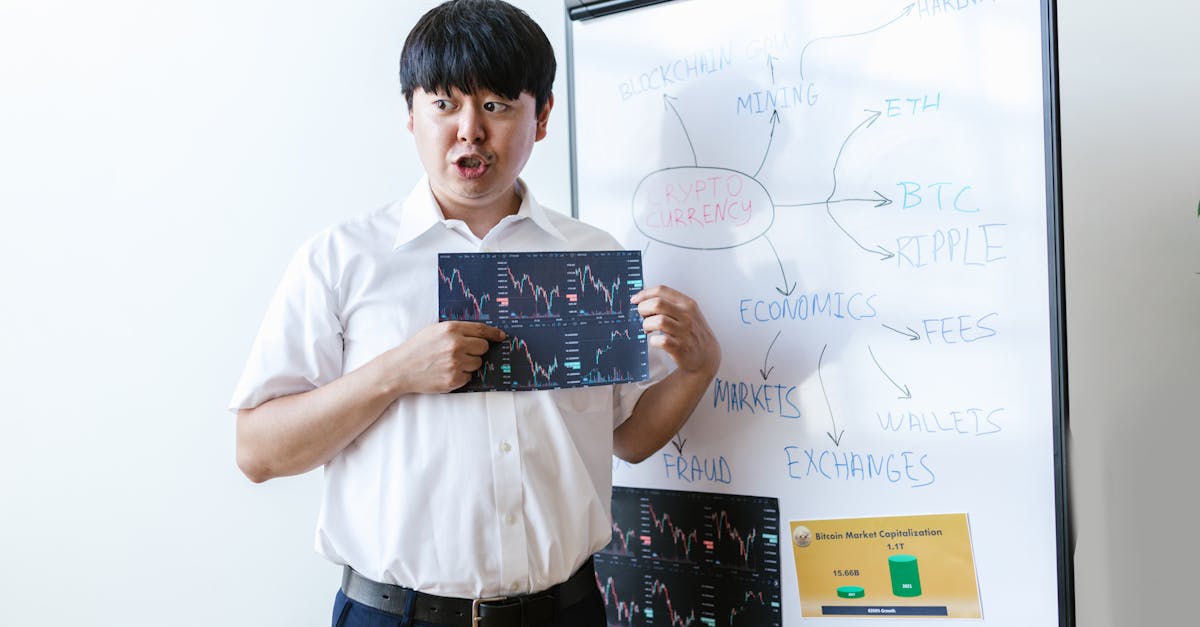

Blockchain Beyond Cryptocurrency

While initially spotlighted by cryptocurrencies like Bitcoin, blockchain technology has grown far beyond digital currencies. This distributed ledger system is now streamlining processes, verifying authenticity, and offering unparalleled transparency across industries. In 2024, companies are leveraging blockchain for everything from secure personal identification to public voting systems, establishing trust in transactions and beyond. Blockchain's power lies in its decentralized nature, eliminating intermediaries and substantially reducing costs. Financial institutions are acknowledging its potential to revolutionize cross-border payments, cutting transaction times from days to mere seconds. As blockchain becomes more ingrained in various sectors, its applications continue to expand, promising a future of enhanced security and efficiency.

Advertisement

The Rise of Decentralized Finance

Decentralized Finance, or DeFi, marks another pivotal innovation shaping the finance world in 2024. DeFi refers to financial systems built on blockchain technology that eliminates the need for traditional banks as intermediaries. Enthusiasts in this space argue that DeFi democratizes finance by providing open and permissionless access to financial services globally. By leveraging smart contracts, individuals can borrow, lend, and earn interest without relying on traditional banking infrastructure. These systems enhance transparency while offering users full control over their financial assets. While challenges remain, such as regulation and security concerns, the relentless growth of DeFi highlights a shift towards a more inclusive financial ecosystem.

Advertisement

Revolutionary Payment Solutions

The age of cashless transactions continues to advance with cutting-edge payment solutions spurred by digital finance innovations. Contactless payments have become ubiquitous, but 2024 introduces biometric payment systems, where fingerprint and facial recognition are standard payment methods. These advancements provide enhanced security while streamlining transactions, benefiting both consumers and merchants. Furthermore, digital wallets are integrating additional services such as loyalty programs and personalized financial management. As technologies evolve, the convenience and speed of digital transactions are set to eclipse traditional payment methods, offering a glimpse of the frictionless financial landscape ahead.

Advertisement

Artificial Intelligence in Finance

Artificial Intelligence (AI) is acting as a catalyst for innovation in the financial sector, optimizing processes and creating new opportunities. In 2024, AI algorithms analyze vast datasets to predict market trends, enabling informed decision-making and investment strategies. Beyond trading, AI chatbots are revolutionizing customer service, offering 24/7 assistance and personalized financial advice. These intelligent algorithms are also improving fraud detection, identifying suspicious activities in real-time to protect consumer assets. By embracing AI, financial institutions are enhancing operational efficiencies and unlocking new possibilities in finance, leading to a more robust and resilient industry.

Advertisement

Financial Inclusion through Fintech

Fintech companies are spearheading efforts to bridge the gap between underserved populations and financial opportunities. Through mobile banking apps and microfinance platforms, individuals previously excluded from formal banking systems now access essential financial services. In 2024, fintech innovations are driving the financial inclusion movement by offering products and services adapted to local contexts and needs. Mobile financial solutions aim to empower users in emerging markets, allowing them to save, borrow, and transact with ease. By eliminating barriers to entry, fintech is playing a crucial role in fostering economic growth and reducing poverty globally.

Advertisement

Cybersecurity in the Digital Finance Era

As financial transactions move online, cybersecurity concerns take center stage. The dynamic realm of digital finance necessitates robust defense mechanisms to protect sensitive data from prying eyes. In 2024, cybersecurity technology has become sophisticated, employing advanced encryption, multi-factor authentication, and real-time monitoring to prevent breaches. Firms are taking proactive measures to educate users about safeguarding personal information and recognizing potential threats. As reactors to ever-evolving cyber attacks, cybersecurity experts are at the forefront, ensuring the integrity and confidentiality of the digital financial ecosystem.

Advertisement

Regulation and Compliance

With innovation, comes the need for regulation, ensuring that digital financial solutions remain safe and equitable for all users. Governments in 2024 are steering to navigate the challenges posed by rapidly evolving digital finance technologies. Developing regulatory frameworks that balance innovation with consumer protection is paramount. Collaborations between regulatory bodies and fintech companies are crucial, promoting transparency and adherence to legal standards. These efforts aim to prevent misuse of technologies and protect consumer interests, ultimately establishing a resilient and sustainable financial ecosystem.

Advertisement

Open Banking and Consumer Empowerment

Open banking is nurturing a new era of consumer empowerment, granting individuals control over their personal financial data. Through secure and authorized APIs, consumers can share their financial information with trusted third-party providers, receiving personalized services that meet their unique needs. 2024 sees increased adoption of open banking platforms, allowing users to manage their finances across multiple institutions from a single application. This convenience results in enhanced user experiences, tailored financial planning, and expanded choices for consumers. Open banking thus symbolizes a shift towards a more transparent and customer-centric approach in finance.

Advertisement

Conclusion

The world of digital finance is evolving rapidly, with innovations in 2024 marking a transformative period for the industry. As blockchain technology, AI, DeFi, and other innovations converge, boundaries are redefined, paving the way for unprecedented opportunities. The synergy between technology and finance is driving momentum towards financial inclusion, consumer empowerment, and operational efficiency. While challenges such as cybersecurity and regulatory compliance remain, these innovations hold promise for a more secure and equitable financial landscape. As we look forward, the impact of these developments is likely to echo far beyond 2024, reshaping the financial industry's future.

Advertisement