Unlocking Financial Frontiers Digital Wallet Insights

Introduction

The digital wallet is revolutionizing the way we handle currency, redefining the age-old concept of money. Gone are the days of worrying about loose change and missing bills; today's transactions occur at the speed of light. Digital wallets, at the forefront of financial technology, stand as a testament to our rapidly evolving digital age. These innovative tools offer convenience, enhanced security, and unprecedented accessibility. Yet, how do they truly work, and what makes them an integral part of the modern financial ecosystem? This article delves into digital wallets' transformative power, analyzing their influence on consumers, businesses, and the global economy.

Advertisement

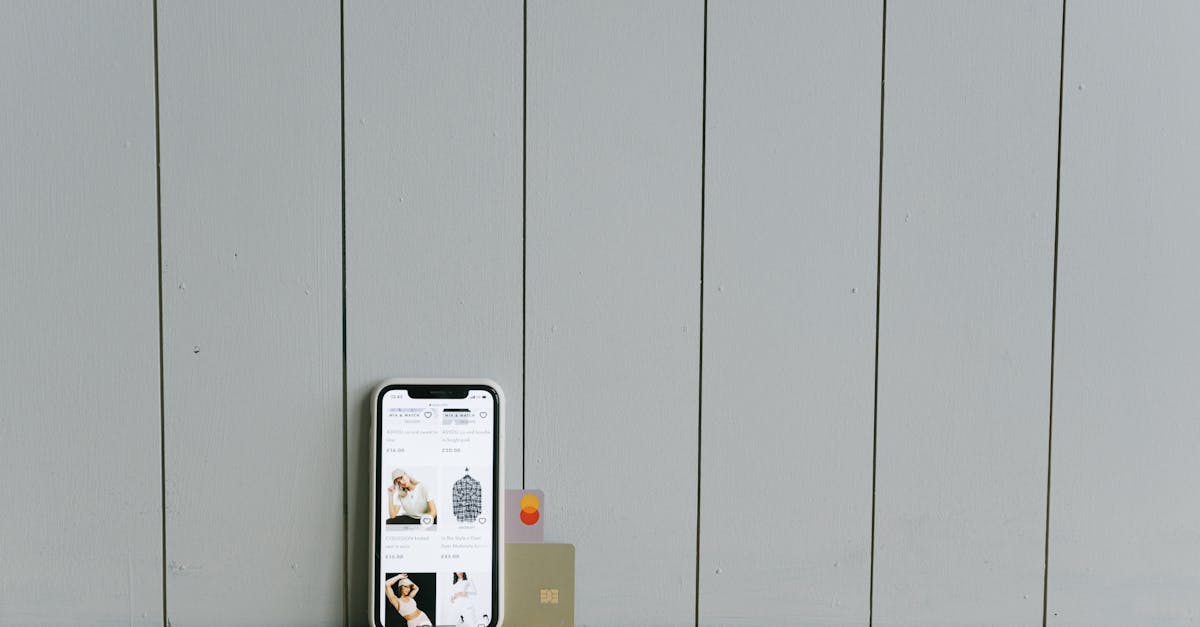

What is a Digital Wallet?

At its core, a digital wallet is an electronic device or online service that allows individuals to make transactions electronically. While the technology varies, most digital wallets use encryption methods to protect sensitive information and streamline financial processes. They can store credit card details, enable online purchases, or facilitate transfers between users, all with just a few taps on a smartphone. As traditional wallets empty, these digital companions are becoming ubiquitous, serving as a bridge between tech-savvy consumers and the digital economy.

Advertisement

The Rise of Digital Wallet Adoption

Digital wallet adoption has skyrocketed over the past few years, driven by widespread internet access and smartphone proliferation. According to recent studies, over two billion people worldwide use digital wallets, with this number expected to grow. The convenience of handling all financial transactions in one secure app appeals to the modern consumer's busy lifestyle. Moreover, the integration with retail websites and contactless payment terminals has directly contributed to this upward trend. As businesses increasingly embrace financial technology, digital wallets stand to gain even more traction.

Advertisement

Security Measures and User Protection

A standout feature of digital wallets is their enhanced security protocols. Unlike traditional payment methods that can succumb to fraud or theft, digital wallets employ encryption technologies, biometric authentication, and tokenization, making them significantly harder to compromise. Fingerprint scanning, facial recognition, and two-factor authentication deliver layers of security that protect user data. Moreover, most digital wallets ensure anonymity, as transactions often involve randomly generated tokens rather than straightforwardly sharing card details.

Advertisement

Digital Wallets in E-commerce

The relationship between digital wallets and e-commerce is symbiotic, with each driving growth in the other sector. Online retailers increasingly offer digital wallet payment options, recognizing the improved conversion rates and customer satisfaction they bring. Shopping has never been easier: with digital wallets, consumers can complete transactions with minimal resistance, reducing cart abandonment rates. This seamless experience encourages brand loyalty and offers an edge in a competitive digital marketplace.

Advertisement

Financial Inclusion and Global Impact

Digital wallets play a crucial role in promoting financial inclusion, particularly in regions where traditional banking infrastructure is limited. MiTi-globally, financial technology is bridging economic inequalities, offering people access to essential financial services through mobile devices. This fosters local business growth, economic development, and global trade expansion. Digital wallets pave the way for more people to engage with the global economy, linking once-isolated communities to international markets.

Advertisement

Cryptocurrency Integration

The rise of cryptocurrency highlights another fascinating frontier for digital wallets. Being at the heart of decentralized finance, digital wallets now accommodate various cryptocurrencies, enabling seamless peer-to-peer transactions. As an increasing number of platforms provide integrated solutions for cryptocurrency trading, users gain access to a breadth of investment opportunities. This integration is not merely about diversification; it offers a glimpse into a future where currency is no longer bound to central banks and traditional institutions.

Advertisement

Contemporary Challenges

Despite their widespread benefits, digital wallets face challenges that need addressing for future growth. Cybersecurity threats remain at the forefront, with tech advancements fueling sophisticated attacks. Regulatory landscapes worldwide vary, leading to hurdles in standardization and cross-border compatibility. Furthermore, consumers must be vigilant regarding potential scams and fraudulent schemes. Education and robust security measures are essential to overcoming these barriers, ensuring digital wallets continue flourishing.

Advertisement

The Future of Digital Wallets

The future of digital wallets promises further innovation. With technology's ceaseless march forward, expect expanded integrations, particularly with artificial intelligence and blockchain solutions. New usage scenarios, like biometric wallets and contactless ID verification, are already emerging. Additionally, environmental concerns will spark innovations in digital payment systems, driving a push toward more sustainable technologies. As industry players collaborate, the digital wallet landscape will continue evolving, ensuring it meets the demands of a dynamic global market.

Advertisement

Conclusion

Digital wallets signify a pivotal shift in how we approach financial transactions. Their ease of use, heightened security, and potential for economic empowerment highlight their transformative impact. As they become more sophisticated, the potential applications of digital wallets are limitless, transforming industries and consumer habits. For consumers and businesses alike, embracing this technology is increasingly unavoidable, offering a promising glimpse into the future of money. By staying informed and adaptable, everyone stands to benefit from this digital revolution.

Advertisement