Revolutionizing Personal Finance Dynamo

Introduction

In recent years, there has been a remarkable evolution in the domain of personal finance management, thanks to the pioneering innovations of what we now know as Personal Finance Dynamo. Revolutionizing how individuals perceive and manage their finances, this concept introduces a blend of modern tools and strategies, effectively turning the age-old challenge of money management into a streamlined and efficient process. Whether you're a college student looking to save on a limited budget or a business professional managing complex income streams, Personal Finance Dynamo offers resources to optimize financial health. The revolution is not just about technology—it's also about mindset. Understanding this shift is crucial for anyone looking to make the most of their financial resources in today's fast-paced world.

Advertisement

Empowering Financial Literacy

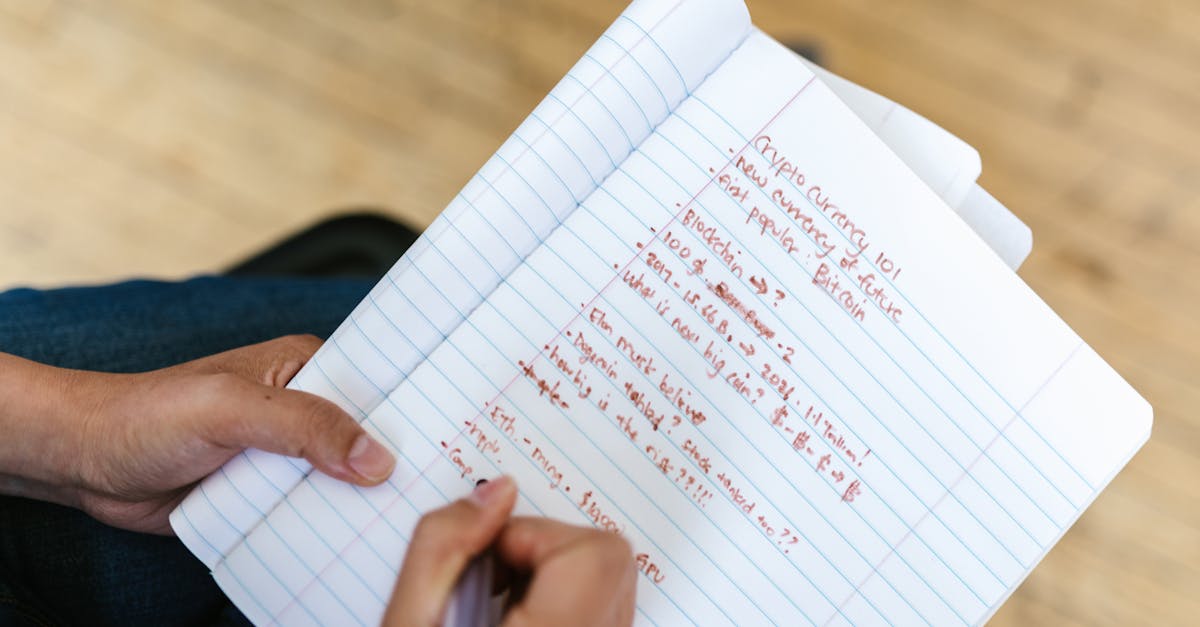

At the heart of the Personal Finance Dynamo revolution is the empowerment of financial literacy. Many individuals find themselves lost when confronted with terminologies like interest rates, investments, and cryptocurrency. However, today’s personal finance platforms come equipped with comprehensive educational resources that demystify these concepts. Offering interactive tutorials, webinars, and easy-to-understand guides, they ensure users are not just following a trend but understanding the **whys** and **hows** of their financial decisions. This push towards education equips individuals to make informed decisions, minimizing the risks associated with poor financial choices.

Advertisement

Budgeting with Precision

Gone are the days when budgeting required cumbersome spreadsheets and manual calculations. Today, with Personal Finance Dynamo, budgeting is a seamless and precise activity. Modern budgeting apps sync directly with your bank accounts, automatically categorizing expenses and identifying trends. This instant financial snapshot helps users identify areas of unnecessary spending and opportunities for savings. Accompanying analysis tools provide recommendations, turning budget management from a chore into an enlightening experience. Ultimately, this personalized approach ensures that individuals maintain control over their finances without feeling overwhelmed.

Advertisement

Harnessing the Power of Automation

Automation has become a cornerstone of the modern financial management landscape. Personal Finance Dynamo capitalizes on this, offering automated services from savings deposits to bill payments. By setting rules and goals, users can ensure consistent contributions to savings, investments, and other financial priorities. Such automation eliminates human error and the temptation to stray from financial goals. Users experience the peace of mind that comes from knowing their financial systems are operating in the background, aligning seamlessly with their long-term objectives.

Advertisement

Goal-Oriented Savings

Traditional saving methods have been revolutionized by today’s personalized and innovative approaches. The Personal Finance Dynamo concept introduces goal-setting features, allowing individuals to earmark funds for specific purposes. Whether it’s saving for a vacation, a home, or an emergency fund, these digital tools provide a visual and tangible representation of progress. Reminders, alerts, and motivational nudges keep users on track, transforming saving from a passive activity into an exciting and rewarding journey. Accountability through visualization ensures users stay engaged and motivated with their savings targets.

Advertisement

Integrating Advanced Analytics

Utilizing data science and predictive analytics, Personal Finance Dynamo provides individuals with unprecedented insights into their financial behaviors and future potential. These tools analyze spending patterns, predict future expenses, and offer suggestions for improving financial stability and growth. With the ability to simulate different financial scenarios, users are better prepared to make informed decisions about investments and spending. In essence, these analytics transform abstract numbers into actionable insights, enabling users to anticipate financial challenges and opportunities with confidence.

Advertisement

Cultivating a Wealth Management Mindset

Embracing a proactive approach to wealth management is an integral aspect of the Personal Finance Dynamo movement. Rather than having money management exist as a vague background task, individuals are encouraged to view it as an active pursuit. Through platforms offering investment tracking, retirement planning, and net worth assessments, users adopt a long-term perspective on financial growth. This mindset shift encourages a comprehensive overview of financial health, driving individuals towards sustainable financial habits that support their objectives and aspirations.

Advertisement

The Social Component of Finance

Social connectivity extends into personal finance, with platforms now offering community features where users can participate in forums, share advice, or even collaborate financially. Peer support enhances accountability and fosters a sense of shared financial responsibility. By engaging with like-minded individuals, users learn from collective wisdom, exchange strategies, and celebrate shared successes. This social component transforms the solitary nature of financial management into a collaborative and enriching experience, enabling users to feel connected as they navigate their financial paths.

Advertisement

Emerging Technologies and Future Trends

As technology advances, so does Personal Finance Dynamo. The integration of artificial intelligence, blockchain technology, and advanced machine learning promises further refinement and innovation in personal finance management. These technologies promise to offer real-time fraud detection, refined investment strategies, and enhanced data security. Keeping abreast of these advancements not only ensures individuals are at the forefront of financial innovation but also encourages a proactive approach to adapting and thriving in a future where personal finance is ever-evolving.

Advertisement

Conclusion

Embracing the Personal Finance Dynamo revolution is a pathway to achieving financial stability, security, and growth. By leveraging technology and fostering financial literacy, individuals are better equipped to handle the complexities of modern financial landscapes. This evolving paradigm shifts the focus from crisis management to proactive planning, allowing users to align their financial practices with their life goals. Ultimately, Personal Finance Dynamo is not merely about money management—it's about empowering individuals to design a financially secure and prosperous future.

Advertisement