Understanding the Impact of Digital Wallets on Finance

Introduction

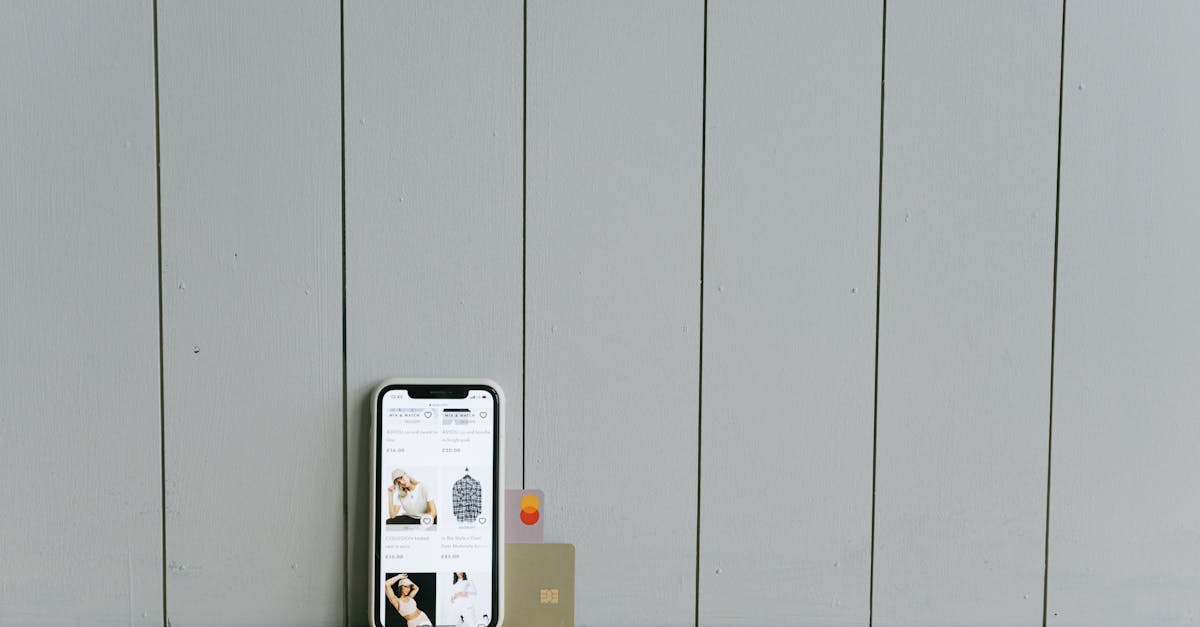

The digital revolution has redefined the way we handle money, and at the forefront of this transformation stands the digital wallet. Digital wallets serve as electronic versions of traditional leather wallets, allowing users to store various payment methods, like credit and debit cards, on their devices. As contactless payments gain immense popularity worldwide, digital wallets provide a quicker, more secure way to make transactions. They bridge the gap between consumers and merchants, facilitating seamless financial exchanges with a tap or a scan. From purchasing a morning coffee to managing monthly subscriptions, digital wallets enhance our everyday economic activities. But how exactly do they work, and what are their implications for the future of finance?

Advertisement

What Are Digital Wallets?

Digital wallets, also known as e-wallets, are software applications or online services that enable individuals to conduct financial transactions electronically. These wallets can store various payment information securely, such as credit card numbers, bank account information, and even loyalty credits. Users can access their digital wallets through smartphones, tablets, or computers, performing transactions without the need for physical cards or cash. Popular digital wallets include Apple Pay, Google Wallet, and PayPal, which have become integral to the landscape of modern payment systems. With the promise of convenience, security, and speed, they are quickly becoming the preferred payment choice for many consumers worldwide.

Advertisement

Security Features and Challenges

One of the primary concerns associated with digital wallets is security. These applications use heavy encryption and tokenization to protect users' sensitive information, minimizing the risk of fraud and unauthorized access. They often require biometric verification, like fingerprints or facial recognition, adding an extra layer of protection. However, despite these security measures, digital wallets are not immune to cyber threats, including hacking and phishing scams. Therefore, users should remain vigilant and practice security hygiene, such as using strong passwords and frequently updating their software, to safeguard their financial information.

Advertisement

Integration With Retail Systems

Digital wallets have seamlessly integrated into global retail systems, simplifying the payment process for merchants and consumers alike. Retailers are increasingly adopting point-of-sale systems that accept digital wallet transactions, recognizing the demand for this payment method. For consumers, digital wallets streamline the checkout process, reducing wait times and providing a cashless, card-free shopping experience. This integration extends beyond physical stores; online retailers offer digital wallet payment options, expanding e-commerce reach. As more businesses adapt to this technology, market growth potential for digital wallets continues to rise, accelerating the shift towards a cashless society.

Advertisement

The Role of Digital Wallets in Financial Inclusion

Digital wallets play a crucial role in promoting financial inclusion, offering unbanked or underbanked individuals access to payment methods and financial services. In regions where traditional banking infrastructure is limited, digital wallets provide an easy entry point into the financial system. They allow users to receive, send, and store money effortlessly, facilitating everyday transactions and empowering them economically. Moreover, digital wallets can function as gateways to additional financial services, such as savings accounts, loans, and insurance, democratizing access to financial products and fostering economic growth even in remote areas.

Advertisement

Digital Wallets and Consumer Behavior

The proliferation of digital wallets is influencing consumer behavior, shaping how users perceive and manage their financial transactions. These wallets eliminate the psychological barrier of parting with physical money, making spending feel less tangible. As a result, some users may be prone to spend more than they would with cash. Simultaneously, digital wallets provide consumers with real-time access to their transaction histories, encouraging mindfulness about their spending habits. The data collected can offer personalized insights and budgeting advice, enabling users to take greater control over their financial health.

Advertisement

Technological Advancements on the Horizon

Advancements in technology promise to further revolutionize digital wallets. Emerging trends, such as blockchain technology, biometric authentication, and AI-driven financial management tools, are poised to enhance the security and efficiency of these payment systems. Blockchain, in particular, offers decentralized transaction verification, enhancing transparency and reducing reliance on traditional banking networks. As these technologies evolve, digital wallets will continue to improve, offering users unparalleled convenience and control over their finances.

Advertisement

Environmental Impact of Digital Wallets

As the world moves towards sustainability, digital wallets offer an eco-friendly alternative to traditional payment methods. By reducing reliance on physical cash and cards, they contribute to decreased carbon footprints associated with their production and distribution. Additionally, the reduction in paper receipts generated by digital transactions lessens waste output. Despite their environmentally friendly aspects, digital wallets do contribute to energy consumption due to the need for constant connectivity and data processing. As the global focus on sustainability strengthens, future innovations will likely address these challenges, striving for more energy-efficient technologies.

Advertisement

Governmental Regulations and Policies

Governments and regulatory bodies worldwide are closely monitoring the rise of digital wallets as their influence on financial ecosystems grows larger. Regulations surrounding their use are becoming more intensive, aiming to protect consumers from fraud, ensure data privacy, and maintain financial stability. These policies strive to balance promoting innovation with safeguarding public interest. As the industry expands, collaboration between governments and tech companies will be vital to creating a framework that encourages growth while protecting individuals and businesses from potential risks.

Advertisement

Conclusion

Digital wallets are more than just a technological trend; they are a transformative force reshaping the way we approach financial transactions. Offering convenience, enhanced security, and a pathway to financial inclusion, they cater to a broad spectrum of users worldwide. However, as with any technological innovation, challenges remain, particularly concerning security, regulation, and consumer behavior. As technology continues to advance, digital wallets will likely integrate more deeply into our daily lives, driving us towards a more connected and efficient financial future. Ultimately, the ongoing evolution of digital wallets promises to redefine the world's economic landscape, unlocking unprecedented opportunities for individuals and businesses alike.

Advertisement