Digital Banking: Riding the Mobile Wave

The New Age of Banking: A Digital Transformation

Digital banking has become a powerful engine of change in the financial sector, drastically altering how we manage money. Thanks to mobile technology, convenience and accessibility are now at the forefront of our financial institutions' offerings. Just ask your neighborhood bank teller, and they'll confirm: paper bank statements and lines at the counter are becoming relics of the past.

Advertisement

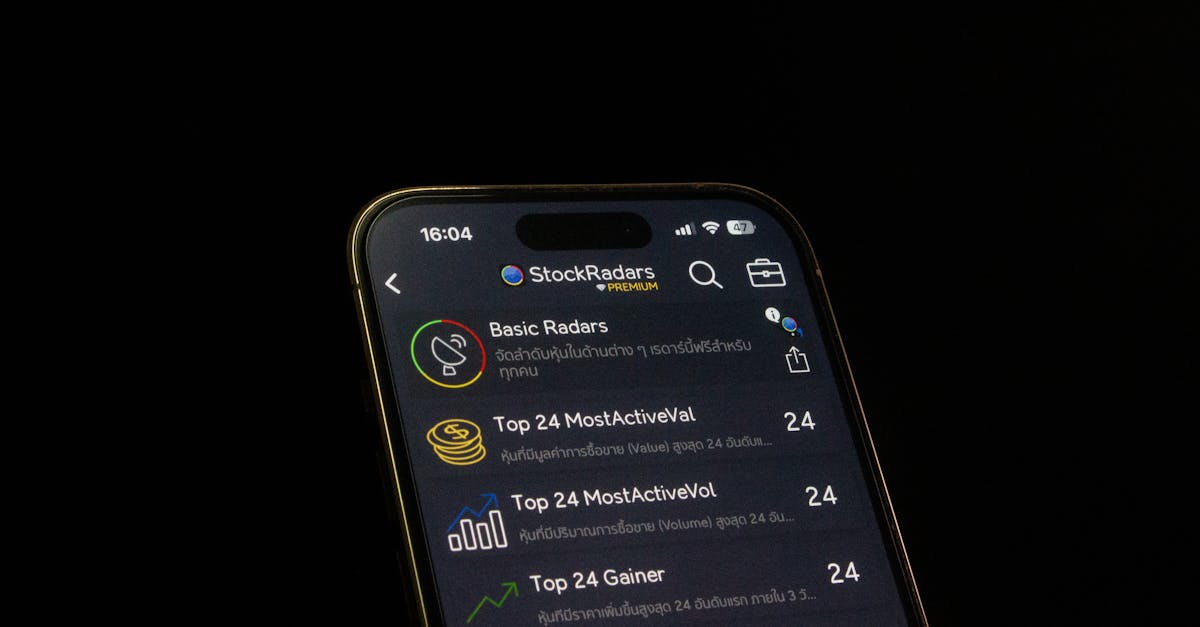

Mobile Banking: A Weighty Contender in the Fintech Arena

The rise of mobile banking apps has made it possible for consumers to manage their accounts from anywhere, anytime. This flexibility is a godsend for those who often find themselves juggling multiple tasks. Whether you're transferring funds while sipping a latte or checking your balance in your pajamas, mobile banking provides unparalleled control.

Advertisement

Why Security is the Name of the Game

With great convenience comes the potential for great risk. Security remains a primary concern as individuals embrace digital banking. Financial institutions are deploying sophisticated cybersecurity measures, including encryption and biometric authentication, to protect customers' sensitive information. This ensures transactions are as secure as a vault-laden fortress.

Advertisement

AI and Digital Banking: A Match Made in The Cloud

Artificial intelligence is making waves in countless industries, and digital banking is no exception. AI-driven chatbots and personal financial assistants are revolutionizing customer support by providing instant solutions to account inquiries. Moreover, AI systems can analyze an individual's spending habits, tailoring personalized advice and sound financial strategies specific to each user.

Advertisement

The Social Element: Banking in The Age of Social Media

Digital banking doesn’t live in a vacuum; it interacts extensively with social media. Banks are jumping onto platforms like Facebook and Twitter to engage with customers, build their brand presence, and gather feedback. From likes to shares, social media acts as an invaluable tool in the digital banking revolution, bridging consumers and institutions.

Advertisement

Challenges in Bridging the Digital Divide

Despite the undeniable advantages, digital banking still confronts some hurdles—the digital divide being one of them. For users with limited access to technology or lacking digital literacy, navigating a mobile banking platform might feel akin to decoding hieroglyphics. Efforts to close this divide include educational initiatives and building intuitive user interfaces.

Advertisement

Looking Ahead: The Ever-evolving Financial Landscape

The future of digital banking is bright and promises continual innovation. With upcoming trends such as open banking and blockchain technology, our financial systems are set to become more transparent and efficient. As we continue migrating to digital platforms, banks must adapt and evolve to meet customers' ever-changing needs.

Advertisement

Wrapping It All Up: The Digital Dancefloor Awaits

Embracing the mobile era, the digital banking revolution is reshaping how we perceive and interact with financial services. As it evolves, offering enhanced convenience, robust security measures, and personalized experiences, the digital banking world presents a wealth of opportunities. And like a well-performed dance, this revolution keeps banking not only relevant but engaging and innovative.

Advertisement